Business Insurance in and around DeRidder

One of the top small business insurance companies in DeRidder, and beyond.

Helping insure businesses can be the neighborly thing to do

- DeRidder

- Merryville

- Rosepine

- Ragley

- Longville

- Dry Creek

- Singer

- Grant

- Sugartown

- Fort Polk

- Oakdale

- Oberlin

- Reeves

- Dequincy

Business Insurance At A Great Value!

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Seth Joubert help you learn about terrific business insurance.

One of the top small business insurance companies in DeRidder, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

For your small business, whether it's a fabric store, a farm supply store, an art gallery, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, business property, and business liability.

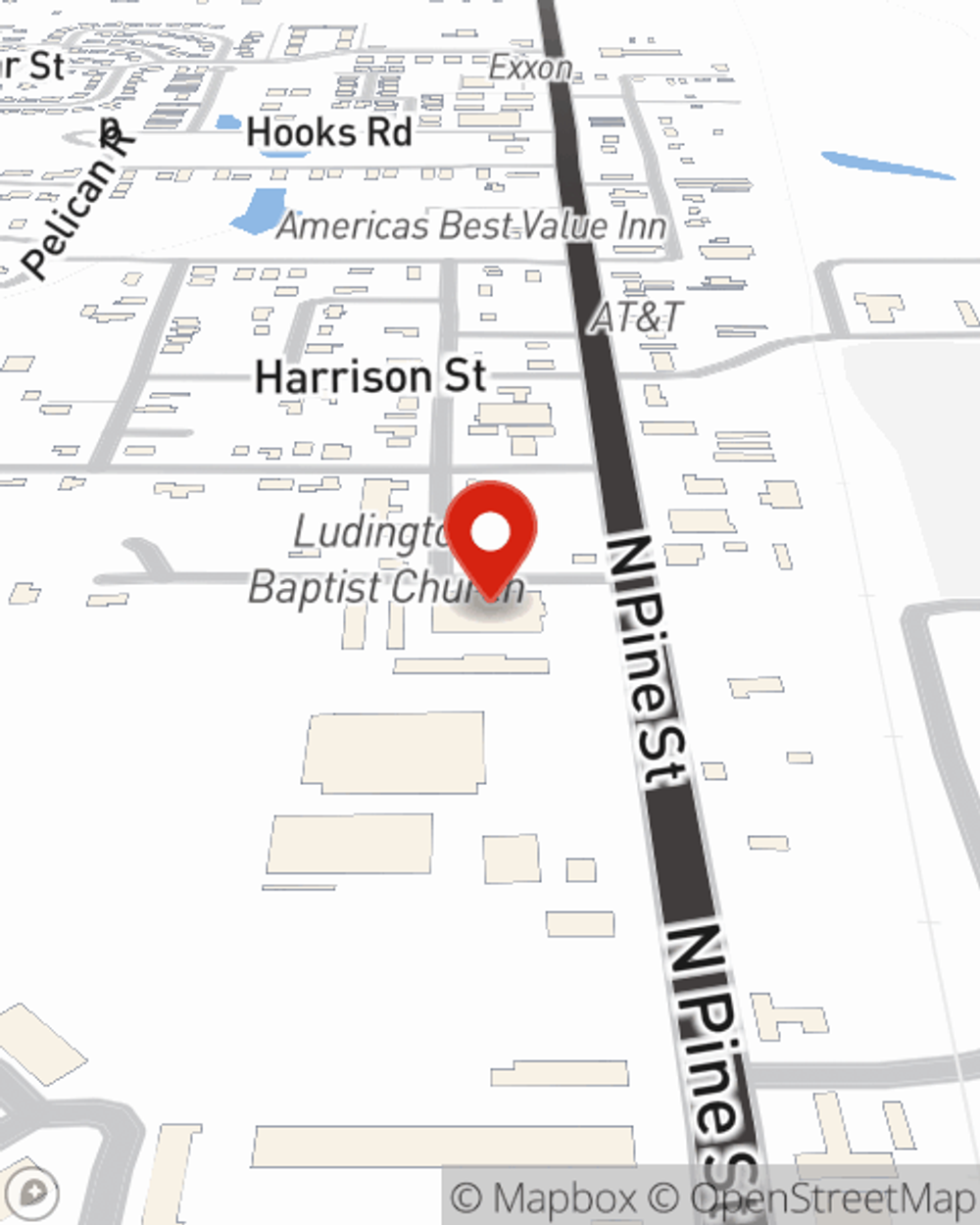

Reach out to State Farm agent Seth Joubert today to check out how one of the leading providers of small business insurance can ease your business worries here in DeRidder, LA.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Seth Joubert

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.